Annual Required Contribution (ARC) Basics

The Annual Required Contribution (ARC) is a key financial metric in pension funding. The ARC represents the minimum amount state and local governments should contribute annually to their pension plans to keep them solvent and sustainable. This summary highlights five major points discussed.

1. Employer and Employee Contributions

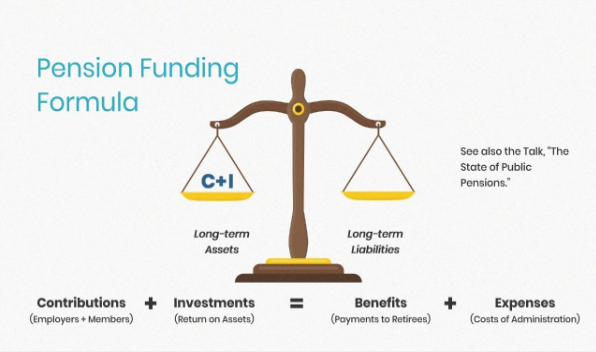

Both public employees and employers play essential roles in funding pensions throughout an employee's career. Unlike private-sector retirement plans that often rely on employee contributions, public pensions depend heavily on continuous employer funding. This shared responsibility ensures that retirement benefits are appropriately financed over time, reducing future burdens on governments and taxpayers.

2. Variability Across Jurisdictions

There is significant variation in pension spending across states and local governments. While most jurisdictions successfully meet their ARC each year, some jurisdictions do not. Factors such as local budget priorities, pension structure, economic conditions, and plan-specific needs can impact each government’s approach to meeting these contributions. Although pension funding requirements are relatively standardized, the amounts governments allocate can differ markedly due to unique fiscal circumstances.

3. Funding Challenges in Some Jurisdictions

Jurisdictions that consistently fail to meet their ARC obligations face growing funding challenges over time. Failing to make these contributions causes the unfunded liabilities—the gap between the plan’s assets and its obligations—to grow, often leading to a “funding shortfall.” This shortfall can create additional costs for the state or local government, as delayed funding increases future ARC amounts due to compounding interest on unfunded liabilities. As a result, it becomes increasingly challenging to balance pension obligations with other budgetary needs.

4. Rising ARC as a Percentage of Payroll

The ARC, as a percentage of payroll, is increasing in many jurisdictions. This means that pension contributions are taking up a growing share of employee payroll costs. Several factors contribute to this rise, including demographic changes (like longer life expectancies), more conservative actuarial assumptions, and investment return adjustments. As ARCs rise, governments must carefully manage their budgets to maintain consistent contributions without compromising other public services.

5. Limits on Contribution Increases

There are practical and political limits on the ability of government plan sponsors to increase contributions. As ARCs rise, governments face constraints due to limited revenue sources, political pressures, and the competing demands of essential public services like education, healthcare, and infrastructure. In some cases, governments may seek pension reform measures—such as benefit adjustments for new hires, increased employee contribution rates, or extending the amortisation period for unfunded liabilities—to balance financial sustainability with public service commitments.

Lessons Learned

The ARC is a foundational concept in public pension financing, serving as a guideline to maintain a pension plan’s financial health. Meeting the ARC consistently helps ensure that pensions remain funded and that future obligations are met without creating undue burdens. However, variations in adherence to ARC requirements, rising contributions relative to payroll, and the limitations on governments’ abilities to increase pension funding highlight the complex balancing act of managing public pensions.

For public employers, the challenge lies in aligning funding policies with long-term pension sustainability while addressing short-term fiscal realities. This summary underscores the importance of actuarial planning, sound financial governance, and policy flexibility to achieve pension security for public employees.